USD Fundamentals: Hawkish Fed Has No Intention of Backing Down, Keeps Option for Another 75bp Hike

The US dollar is making fresh 20-year highs today, with the broad DXY index pushing at levels above 114.00. The move comes after a hawkish 75bp rate hike by the Fed last Wednesday. GBPUSD made an all-time record low overnight at 1.0337, EURUSD is at the lowest since 2002, and USDJPY is at the highest since 1998. This is some exceptional US dollar strength.

The long-term fundamental reasons behind the strong dollar are well-known, as we discussed them on multiple occasions here in the weekly Fx blog and our newsletter. The trigger last week was the Fed, which not only raised rates by a “large” 75bp but also indicated (via the dot plot projections) that another 75bp hike is possible in November. The dot plot also showed the Fed intends to keep interest rates above 4.5% throughout next year.

The hawkish tilt of the meeting was what USD bulls needed to push the currency to fresh cycle highs. The fresh bullish impetus only serves to amplify the already existing long-term bullish trend in the US dollar.

On the US calendar this week, the markets will watch a range of Fed speakers, including Chairman Powell on two occasions (Tue and Wed). More comments from Fed officials that another 75bp hike is likely at the November meeting should keep the USD well-supported.

Regarding economic data, all focus will be on the important PCE inflation report due on Friday. Remember that this is the Fed’s preferred inflation measure (not CPI) which they use in their forecasts. The dollar should stay bid on this release unless the actual figures come in significantly lower than expectations.

EUR Fundamentals: Escalations in Ukraine and Italian Elections of no Help to Euro

The common EUR currency simply can’t get a break from bad news. Adding to its woes last week were escalations in Ukraine as separatist regions that are held by Russia are voting in referendums to join the Russian Federation. It was reported President Putin has said that all weapons (including nuclear) can be used to protect Russian territory. Such statements scared the markets and triggered euro selling.

Italy voted in a general election over the weekend, and right-wing populist parties emerged as clear winners. This is more bad news for the EU as the new government may not want to be fully aligned with EU policies. This means potential more internal conflict within the EU and political fragmentation. The election results certainly don’t inspire anyone to buy the euro.

The energy crisis remains a long-term and persistent issue. It is the main and largest factor behind the EUR bearish trend this year. Given the latest developments, the trend remains intact, especially in EURUSD, although the euro is holding up better versus other currencies (which are also very weak right now).

The EUR economic calendar also focuses on inflation reports, with Friday’s flash CPI data for the whole Eurozone getting the main attention. The CPI reports for individual countries will be released earlier and could have an impact in the Fx market, especially the German and French numbers.

EURUSD Technical Analysis:

Last Monday, we said more downside is the probable scenario for EURUSD. That has, in fact, transpired over the past week, and EURUSD tested a fresh cycle low around 0.9550 overnight.

The downtrend is in full swing here, and few want to stand in its way. The bearish channel formation shows us there is some more scope for a further drop below today’s low, although the move is now entering into extended territory. For instance, the daily RSI (shown below) has dipped below 30, which technically indicates oversold levels.

Nonetheless, the momentum of the bearish trend is strong, and it can continue for a while longer, despite technical indicators showing oversold levels. The 0.95 zone is the big focus as an important support zone. However, the channel’s support line can extend toward 0.94 as the next support zone lower.

To the upside, the prior lows around 0.99 should be the first resistance. Above it, the 1.00 zone remains the key technical focus for traders.

GBP Fundamentals: Sterling Flash Crash Overnight after Investors Lose Confidence in Truss Fiscal Plans

The pound is opening the week near record low levels after a flash crash overnight, which saw GBPUSD fall over 300 pips in a matter of minutes. EURGBP also surged higher, almost to 0.93, as the GBP is the outlier weakest currency in the last two trading sessions (Friday and today), losing over 5%.

The gigantic fall in the value of sterling is a clear signal from the market that investors have lost confidence in the budget spending plans of Liz Truss’ government. Indeed, the announcement of the new fiscal plan on Friday triggered the initial move down in GBP, which has now extended into today’s session. GBPUSD fell from 1.12 before the announcement to 1.0337 today, an almost 900 pips decline!

The market’s attention will now turn to the Bank of England and the HM Treasury for potential action they may take to stabilize the pound. Traders need to watch out for that. The options the BOE has are a giant rate hike (perhaps 500bp) or a delay in planned QT (UK bond sales). However, unlike Japan, the UK authorities have limited scope for direct currency intervention to prop up the pound due to the UK’s low amount of Fx reserves (around 200 billion USD). This amount is too low relative to the size of the UK economy (3-5% of GDP) and isn’t enough to defend the currency.

For comparison, even emerging market countries have higher reserves than the UK (usually around 30% of GDP is the minimum), and other developed economies like Switzerland have more than 100% of GDP in reserves. Hence, without financial power to defend it via intervention, GBP is at the mercy of markets for how much it can fall further.

A giant rate hike from the BOE may also not be enough in the current environment, given the government’s plans to increase the budget deficit, which rate hikes then make even worse. GBP is between a rock and a hard place, and a further slide down is not hard to imagine. GBPUSD could as well reach parity (1.00) and EURGBP climb to 0.95.

GBPUSD Technical Analysis:

Disorderly is the word to describe the decline in GBPUSD on Friday and today (Mon). The trading range for those two days is around 930 pips!

The charts and technical analysis can tell as much in such situations. GBPUSD is now completely in uncharted waters, and who knows where the bottom could be. A lot will depend on what actions UK policymakers take or don’t take (check previous section). The low could be the one set today at 1.0337, or GBPUSD could fall to parity (1.00) or even lower.

To the upside, it’s a little easier to find important technical levels, but even in this case, the volatility is so high that any levels may be of little use for short-term traders. Based on the weekly chart, we can say the 1.10 and 1.15 zones should act as resistance.

To the downside, 1.00 – if reached – should attract some bullish pressures, though, as noted above, it remains highly uncertain how much impact that would have to stop a further decline below parity.

JPY Fundamentals: Currency Intervention Can Slow, But Unlikely to Reverse the Yen Downtrend

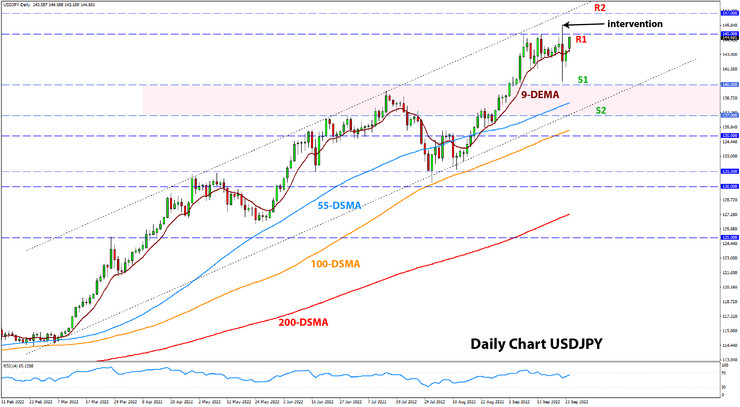

Much as we warned in recent weeks, further yen weakness last week triggered “real” intervention in the Fx market to stop the yen. The Bank of Japan and the Ministry of Finance announced last Thursday that they have used Fx purchases to intervene in the market against JPY’s weakness. The policy action comes after recent communication from Japanese officials that they are considering such an option.

Considering these developments, it seems the 145.00 level is an important line in the sand for the BOJ and MoF. The intervention came when USDJPY crossed above 145.00 again Thursday, hours after a dovish BOJ meeting when they kept interest rates unchanged near zero while continuing with the QE and YCC policies.

Indeed, it is the BOJ’s dovish policies that are the main fundamental factor driving the yen down. And as long as those remain in place, it’s unlikely that any intervention will be enough to reverse this downtrend. However, intervention can help to slow down the pace of the decline and temporarily prevent it from falling further. It seems that is what the BOJ and MoF were trying to achieve with the action last Thursday.

USDJPY Technical Analysis:

USDJPY continues to consolidate sideways and flirt with the 9-period EMA (purple line). It did dip below the 9 EMA on the intervention last week but quickly got back above it and is now making another attempt toward the 145.00 zone.

The 145.00 area should be resistance, but a break above it will again put USDJPY in uncharted territory. The 147.00 zone – a multi-decade high from 1998 – could be the next resistance higher. The next resistance would likely be the 150.00 area.

To the downisde, the 140.00 zone remains the key focus as the first support. It was almost tested last week, but USDJPY bounced before reaching the level.

Under 140.00, the next support is the 137.00 zone, which may turn out to be very important if tested. Namely, a rising trendline is lining up in this area, in addition to previous highs and lows. The 135.00 zone is also not far; this whole 135.00 – 137.00 area may be tested as one wider support band. It won’t be a surprising scenario now, especially given the enormous volatility in USDJPY and also the Fx market in general.