USD Fundamentals: Correction Stops; Can the Dollar Rebound?

Some sideways consolidation was to be expected for the past trading week following the giant 4.5% dollar (DXY index) decline the week before. Some strong retail sales data and renewed hawkish commentary from Fed officials – with most viewing the big move after the CPI report as an overreaction – helped to stabilize the USD last week.

The question that is asked more loudly in trading circles now is, has the USD bull trend peaked? But a much easier question to answer is whether a USD downtrend has started on that CPI report? And the answer to that is most likely NO.

Even if a USD peak (that’s a big IF) was cemented in place with the CPI report on November 10, that doesn’t mean a downtrend is starting. In fact, even in a scenario where a top is behind us, there is still a lot of scope for the dollar to come back and make another upside attempt (e.g., at least to the 110.00 - 112.00 area in DXY). As discussed in the Free FxTR newsletter, one “good” CPI report won’t get the Fed to change its policy. More interest rate hikes and QT from the Fed are coming, and when markets realize that, we may get the start of a new bullish USD leg. It will remain to be seen if such a bullish leg surpasses the previous high (114 in DXY), or it may only come near it.

The US economic calendar is relatively light for the coming week, which also sees the Thanksgiving holiday on Thursday and Black Friday when some financial markets will be closed (Forex remains open). The focus will be on the FOMC meeting minutes (Wed) and several Fed speakers scheduled throughout the week. Durable goods orders, the UoM consumer sentiment index and US flash PMIs will also be worth keeping an eye on; however, these reports are 2nd tier and thus are unlikely to have a big market impact.

EUR Fundamentals: Watching Wednesday PMI Reports As Eurozone Recession Looms

The past week saw a general consolidation across all markets and currencies of the large moves triggered by the big miss in the US CPI report. EUR pairs acted accordingly, and nearly all corrected lower or consolidated sideways.

Indeed, not much (if anything) about EUR fundamentals has changed over the past two weeks. The outlook for the economy remains dark, with a warm autumn so far helping to relieve fears about gas shortages as Europeans are using less heating. But the future remains highly uncertain as gas imports remain low, with the biggest supplier – Russia – now being almost completely cut off. A Eurozone recession is now the base-case forecast of most economists and financial institutions, with the only question being how severe it will be.

Indicators like the widely followed PMIs and German ZEW reports continue to point to a deep recession in Europe over the coming months. Such a scenario clearly puts the fundamentals strongly bearish, which is why it’s hard to imagine the EURUSD bounce running much further higher than it already has. Europe is still in a pretty bad spot without cheap Russian gas, and there is nothing in sight to suggest that the EU will have normal gas prices any time soon. Thus, these long-term factors are likely to remain dominant for a while longer and reinstate bearish pressures on the EUR currency.

The Eurozone calendar this week sees the release of the flash manufacturing and services PMIs on Wednesday, which as mentioned above, already point to a recession (both readings below 50). The German ifo business climate index due on Thursday is also a good leading indicator of economic activity and also points to a significant slowdown in the Eurozone economy. The euro can certainly start falling again from here, especially if the economic reports this week disappoint even those “low” expectations.

EURUSD Technical Analysis:

While EURUSD pushed as high as 1.0480 last week, it did not manage to break through the wider 1.0350 resistance zone in a meaningful way. The pair is now backing off further from the resistance and is already trading below 1.03 as of today’s (Monday) session. It also wasn’t able to close above the 200-day moving average (red).

Still, a complete rejection of the powerful rally above parity is still some way off. In fact, EURUSD will need to return back toward 1.00 before the whole corrective rally can be declared as rejected. In that case, the sentiment will switch back to bearish, and we’ll watch the 0.9750 and 0.95 zones as support.

For now, however, the focus will remain to the upside. A break above the 200 DMA can still open further upward potential, with the 1.05 area the next resistance zone higher. Above there, 1.0750 is the resistance zone traders will watch.

GBP Fundamentals: Budget Announcement By Sunak Government Received Well, But Sterling’s Rally May Be Nearing Its End

The big event for GBP last week was the new budget announcement which went well judging by the calm market reaction both in the Fx market (GBP) and bonds (UK Gilts). The new measures that were announced are a welcome development following the debacle of the Truss Government that led GBP to fall to an all-time low in September.

However, with that now being all behind us, the question is, what else can be GBP bullish from here. And the answer is very little!

Like the rest of Europe, the energy crisis is causing a significant economic slowdown in Britain, likely resulting in a multi-quarter recession (as forecasted by the BOE itself). This is hardly a bullish backdrop on which GBP can build further gains.

Furthermore, the risk environment remains fragile, with central banks globally being the most hawkish they’ve been in 40 years. This is not the best environment where risky assets can flourish. With the pound being a relatively risk-sensitive currency (similar to AUD, NZD), the risk environment will likely continue to act as a headwind

This week, the UK economic calendar is relatively light, with only the PMI survey reports in focus (also expected below 50, like for the Eurozone). Several BOE speakers are also scheduled throughout the week, and while the market will listen to their comments, there isn’t much new they can say at this stage that could help GBP further.

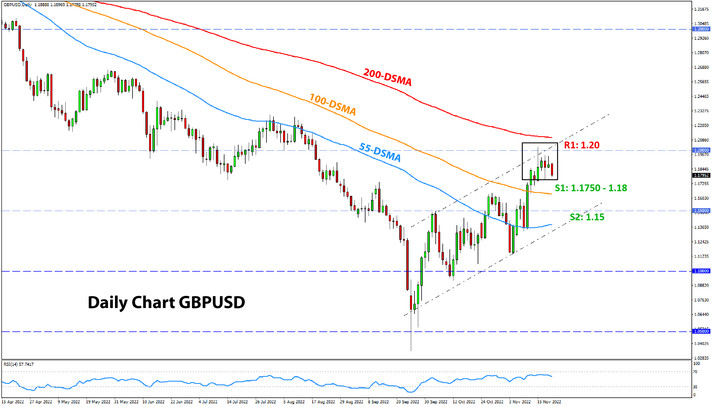

GBPUSD Technical Analysis:

Cable is also getting rejected, though it briefly went even above 1.20 last Tuesday before coming down sharply. Given the significance of the 1.20 area for GBPUSD, it’s possible that was the high of the corrective rally.

A potential move further above 1.20 will bring the 1.2250 zone in focus as resistance. The 1.18 zone remains technically important but now as support.

However, a look at lower timeframes suggests that 1.1750 could be the breaking point that will confirm a reversal down. The recent compression trading range has already recorded several lows near 1.1750, indicating a lower break will clear the way for more downside action. This can be seen on the smaller charts.

The 1.15 zone is the first support down where GBPUSD is likely to react in such a scenario.

JPY Fundamentals: Japan’s Core CPI Also on the Rise (3.6% y/y)

The yen has also entered consolidation mode, with USDJPY now creeping back above the 140.00 level after having fallen as low as 137.65 last Tuesday. The action almost mirrors what is going on in the 10-year US Treasury yield, which is suggestive that a resumption of the uptrend in yields is needed to get USDJPY moving up again.

An interesting development of note last week was that Japan’s inflation is also on the rise, as the National Core CPI showed Friday. Core CPI y/y surprised to the upside at 3.6% vs the 3.5% forecasts. Some have already started speculating that even Japan can’t be immune from the global surge of inflation. However, for now, the Bank of Japan still views this as only temporary and considers deflation to be the biggest threat to their economy. Thus the BOJ retains an ultra-dovish policy stance.

With that in mind, the JPY exchange rates should continue to be driven primarily by relative movements in global bond yields. The BOJ keeps Japanese Government yields at 0%, and if yields of other countries (USA, Europe) begin to rise again, then we could see renewed bullish pressures on JPY pairs (bearish yen).

For this week and over the near term, some further consolidation across the Fx market makes sense, especially given the shortened trading week because of the Thanksgiving holiday Thursday. On the calendar, the BOJ core CPI (Tue) and the Tokyo core CPI (Fri) will be worth watching to see if they confirm the rise in the national core CPI report last week.

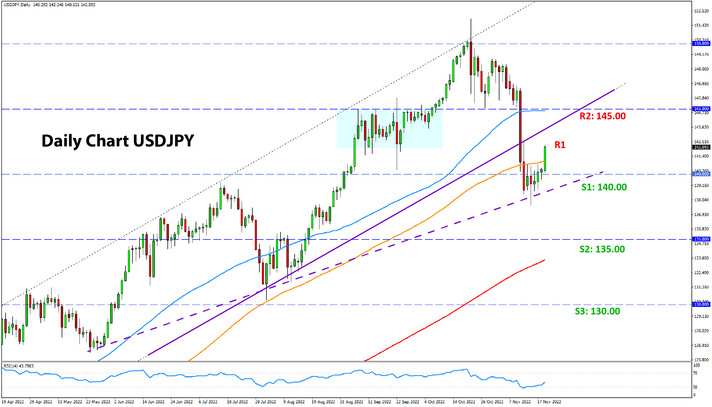

USDJPY Technical Analysis:

USDJPY is trying to recover from the big sell-off, managing to climb above 140.00 already this week and now testing the 142.00 resistance zone. A further push higher could soon see 145.00 being tested, which is arguably the next important resistance higher.

It remains to be seen whether USDJPY will consolidate sideways here or take a sharper pullback higher toward 145.00. Considering the large moves, some consolidative range emerging here wouldn’t be a surprise. To the upside, 145.00 should be a solid resistance if it’s reached, while the current one (142.00) is a more modest resistance.

To the downside, the big focus should be on 130.00 as the robust support zone. While USDJPY bounced from around 138.00, it is not a very significant technical zone, so the support here is not very strong. The next one lower should be the 135.00 support zone.