USD Fundamentals: All Eyes on Powell Speech and Nonfarm Payrolls; Further Declines Harder to Come By

The US dollar continues to consolidate in a range for the third week following the big 2-day decline driven by the November 10 CPI report. As we discussed in last Monday’s Fx weekly, the consolidation is a normal phase after such a sharp correction driven by a one-off CPI release. The broad DXY dollar index is already showing some signs of stabilization and potential for a rebound, which could mean this correction within the larger USD bull trend may already be ending.

The week ahead could potentially prove decisive for the dollar trend, depending on the outcomes of the scheduled high-impact events. The key focus will be on Fed Chair Powell’s speech (Wed), the PCE inflation report (Thur), and the Nonfarm Payrolls and other jobs reports (Fri). Each of these events - if there are some large surprises from expectations - could induce a new surge in volatility.

Overall, given how much the dollar has already corrected since November 10, the space for a further USD decline seems to be shrinking. Instead, it now looks there is greater potential for a USD rebound, should e.g., Powell is hawkish or the NFP prints another robust number.

EUR Fundamentals: Fx Traders Watching CPI Inflation Data on Tuesday and Wednesday

The flash PMI survey reports released over the past week were slightly above consensus estimates, but it seems that was enough to keep hopes alive that the coming Eurozone recession won’t be very severe. The euro maintained its recent gains; however, it’s a question if that can last for much longer.

While a bit higher than expectations, all the PMI reports were clearly in recession territory (below 50 readings indicate contraction). This is not something to cheer about, and in fact, the PMIs and GDP growth could still get worse further over the coming months. A deep Eurozone recession still looks like a very plausible scenario, which would be EUR bearish, all else being equal

The focus on this week’s European calendar is CPI inflation. Reports from individual countries (Germany, Spain) will start rolling in tomorrow (Tue), while the aggregate CPI release for the whole Eurozone is due on Wednesday. Below-estimate prints in those CPI reports could be a catalyst for some reversal of the recent EUR gains, while it’s questionable if high numbers can fuel further EUR rallies at this stage.

Speeches from ECB officials will be closely watched by Fx traders. Of note is President Lagarde’s speech scheduled for Friday.

EURUSD Technical Analysis:

EURUSD re-tested the 1.05 resistance today but again got rejected. This is the 2nd rejection of higher levels here in two weeks. It is the first clearer sign that the resistance at 1.05 is robust and that an upside break won’t happen easily. The daily RSI is near the 70 level, indicating EURUSD is close to overbought levels now.

EURUSD has already rallied 950 pips off the September lows. That is a massive move already and can be taken as an indication that this rebound has already run a lot. Further gains are likely to be much harder to come by at these high levels and now that oversold conditions have been greatly corrected.

The chart formation now looks like a double top. It remains to be seen if this leads to a bearish move from here. The first support zone down is 1.0250. Below it, 1.01 and 1.00 (parity) come into focus as the next key support zones.

GBP Fundamentals: Turning Lower with Risk Sentiment

The pound had another decent performance last week, as risk sentiment stayed supported and stocks rose. However, that seems to be changing already on the opening of the new trading week, as both stocks and GBP have taken a turn lower.

The optimism fueled from the Government change in the UK and the new, more conservative budget plan also seems to be fading at this stage, together with GBP’s rally. A recession in the UK is coming soon, and it may be a seriously bad one. The markets seem to be realizing this now, as we warned in our recent analysis posts, and GBP is moving down quite steeply in today’s Monday trading session.

Risk sentiment is hit this week by news from China that protests have erupted in several cities because the Chinese Government doesn’t want to loosen Covid restrictions. So far, the selling in stocks is contained, but if the Covid news out of China gets worse, the stock market sell-off could accelerate too. A big decline in stocks would be GBP bearish. A move back toward 1.15 in GBPUSD and up to 0.88 in EURGBP is a probable scenario for the pound sterling if stocks continue falling.

The UK economic calendar is very light this week and is unlikely to be a source of GBP volatility.

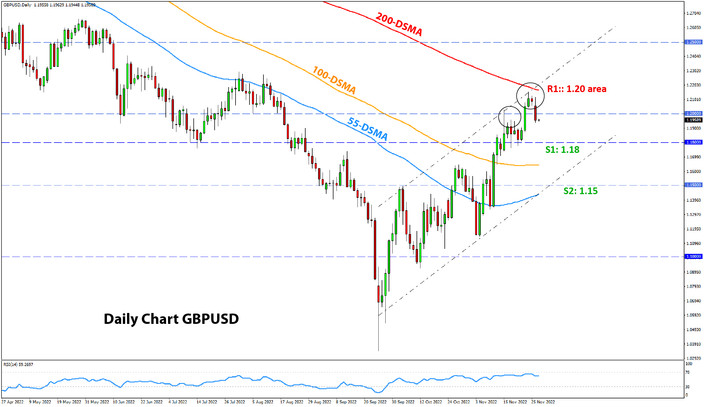

GBPUSD Technical Analysis:

GBPUSD is slipping back below 1.20 today from the high of 1.2150 last week, which is suggestive that the 1.20 area is holding as resistance. The 200 pips move down and the break of some intraday support levels indicate a change of the short-term sentiment to bearish.

The next levels cable may attack to the downside are 1.18 and 1.15. These are the key support zones where we can expect some market reaction. The 1.19 zone, where the prior highs are located, is also a moderate support. This can be reached soon.

To the upside, the 1.20 area is robust resistance. But as we saw last week, such major technical areas based on the monthly chart can be 200-300 pips wide as GBPUSD reached a high of 1.2150 before reversing.

JPY Fundamentals: Correction Stops, What’s Next?

The yen strengthened notably at the expense of the dollar (after that November 10 CPI miss), which also helped fuel a broad correction down in JPY pairs. However, there has been no follow-through of the moves since then, and the JPY’s recovery has stalled.

Overall, the yen remains strongly correlated with moves in Government bond yields, in particular US Treasuries. Thus, a new upside move in US Treasury yields will likely be needed to push USDJPY higher again. In this sense, it’s hard to say whether US yields can reach the highs from October, considering that the 10-year Treasury is already notably down (currently at 3.7% vs 4.35 at the peak).

Unlike for EUR and GBP, lower oil and fragile risk sentiment are not bearish JPY factors. Cheaper oil will help to reduce Japan’s trade deficit (which widened after Russia’s invasion in Ukraine), while risk aversion and falling stock markets can give JPY a boost via safe-haven flows. Thus, if bond yields don’t resume the uptrend from earlier this year, the JPY is likely to be in a better position than EUR and GBP to resist any US dollar strength.

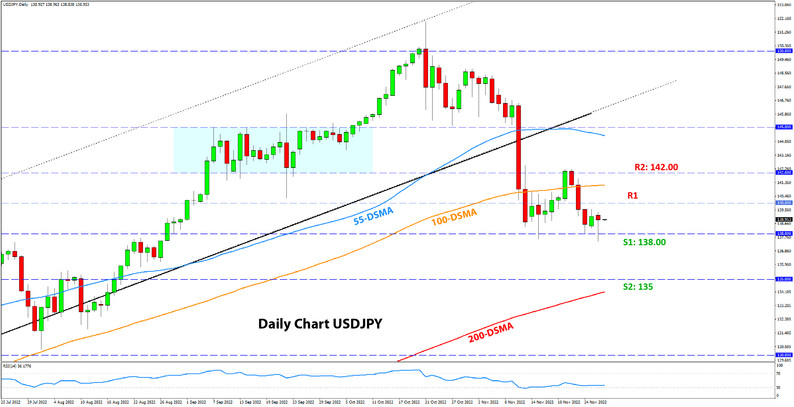

USDJPY Technical Analysis:

USDJPY is making a strong bounce off the 138.00 level today, with what looks almost like a bull hammer candle on the daily chart (upper shadow is too long, so it’s not textbook hammer). This could mark a double bottom formation if USDJPY extends higher. The 139.00 level is not far from here, and if USDJPY crosses back above 140.00, the odds for a further extension higher will increase.

The 140.00 zone is the first resistance. Above it, 142.00 and 145.00 are the next resistance zones traders will watch.

To the downside, 138.00 is now solid support. Other support zones below it are 135.00 and 130.00.