A Brief Introduction to Amega

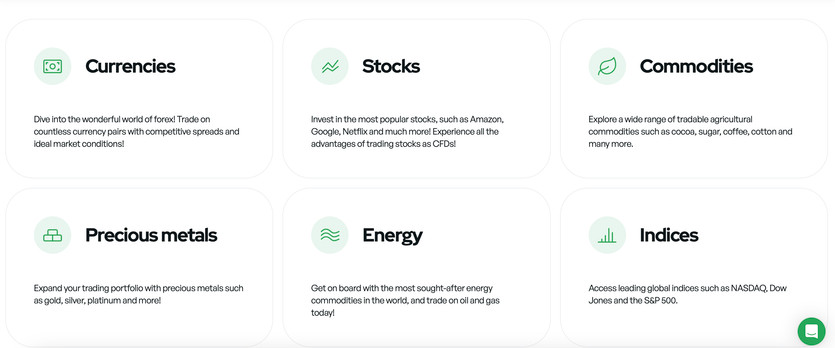

Amega, a digital brokerage platform, extends a zero-commission trading gateway to a multitude of assets including currencies, stocks, commodities, indices, and precious metals, among others. Boasting spreads as low as 0.1 pips and a leverage ratio that can scale up to 1:1000, Amega ensures favourable trading conditions irrespective of the size of your deposit. It's a globally accessible platform, servicing clients from around 50 countries with the widely-adopted MetaTrader 5. Amega comes under the purview of Mauritius' Financial Services Commission, with segregated accounts to assure additional client protection.

The Upsides and Downsides of AmegaFX

Advantages

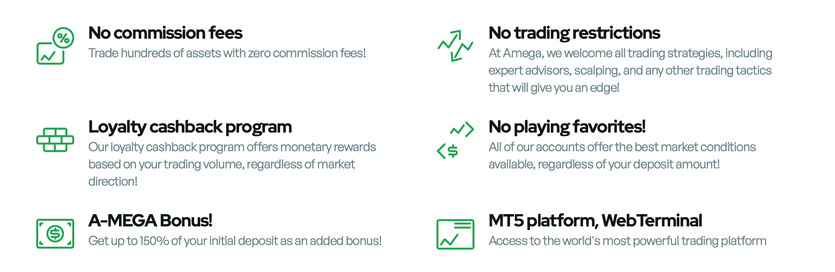

- All asset trading comes with no commission, encompassing forex and stocks.

- Traders can avail of the Loyalty Cashback Program, which pays back based on the volume traded.

- Supports all trading strategies, including robots and scalping.

- Traders have the opportunity to magnify their profits with high leverage up to 1:1000.

Disadvantages

- Regulatory oversight is restricted, with Amega not regulated in regions like Europe, North America, or Asia Pacific.

- Offering high affiliate commissions to entice new clients could inadvertently result in biased reviews.

Is AmegaFX for You?

Amega, with its commission-free trading and diverse asset selection, has managed to appeal to traders around the world. Notably, the platform is inaccessible to residents of the USA, North Korea, and Iran. While it presents competitive trading conditions for both amateur and experienced traders, the platform may not be beginner-friendly, as it lacks exhaustive educational tools. However, the availability of free demo accounts enables users to learn and adapt at their own pace. The platform further incorporates an instant cashback scheme, providing an additional draw for traders. Also, Amega caters to Muslim traders with specially designed Islamic accounts.

AmegaFX: Regulation and Account Options

Regulated by Mauritius' Financial Services Commission, Amega provides an array of account options. The non-advisory/executionary broker requires no minimum deposit, supports scalping, and offers a free demo account.

Key Features of AmegaFX

- Zero Commission Trading: Amega's commitment to affordable trading means it charges no commissions on trades.

- Diverse Asset Classes: With a variety of assets like currencies, stocks, commodities, and precious metals, traders can diversify their portfolio.

- High Leverage: With leverage up to 1:1000, traders can open positions much larger than their account balance, potentially maximizing profits.

- Loyalty Cashback Program: The unique program rewards traders based on their trading volume.

- Ultra-Fast Execution: With a processing speed of just 0.1 seconds, traders can act swiftly on market movements.

Compliance & Regulation

Amega abides by the guidelines of the Financial Services Commission (FSC) in Mauritius, though it lacks regulation from major authorities in Europe, North America, or the Asia Pacific.

How Secure is AmegaFX?

To safeguard client assets, Amega maintains segregated customer accounts with authorized third parties. This strategy protects client funds from any economic fluctuations impacting the broker's fiscal stability.

User Experience with AmegaFX

Amega offers an intuitive and user-friendly website, employing the efficient MetaTrader 5 platform for a seamless trading experience. Account setup is simple, and customer support is proactive, overall ensuring an enjoyable journey for online traders.

A Closing Note on AmegaFX

In conclusion, Amega, with its zero-commission trading and diverse asset portfolio, has made a mark among value-conscious traders employing diverse strategies. The use of MetaTrader5 adds to its appeal. However, the limited regulatory oversight in some areas could cause credibility concerns. Also, the unavailability of Amega's services in certain countries like the U.S., Iran, and North Korea poses a limitation. It's essential that clients balance the benefits against any potential risks associated with a broker's regulatory status.