Falling inflation is no reason for EURUSD to move higher

It’s rather absurd what’s happening in the EURUSD pair after the US CPI report yesterday, and makes little sense fundamentally. Falling inflation in the United States is no reason to be bullish EURUSD. In fact, quite the opposite should be the case because if inflation in the US is declining, it will surely decline even faster and harder in Europe.

As we discussed on several occasions in our recent weekly Fx analysis posts (like here and here), the underlying state of the US economy is much healthier than in the Eurozone. Consequently, the inflation generated in the US is of “stickier” nature (meaning harder to bring down) because it is much more demand-driven (aka economic strength). In contrast, Eurozone inflation is largely due to the bizarrely high gas and electricity markets, with much less of it driven by demand factors. This type of energy inflation comes down much more easily, especially when there is no strength in the economy to keep the upward inflationary pressures.

Considering the above, the ECB simply is in no position to match the Fed’s tightening and hawkishness. This, ultimately, should prove a bearish EURUSD factor, not bullish. Hence, the current levels on EURUSD still look like a great opportunity to go short.

The technicals also favour a reversal down from here (more on that below).

EURUSD at robust resistance into Fed meeting

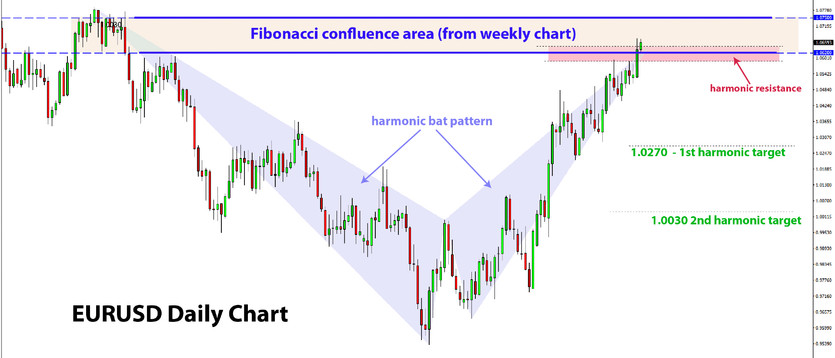

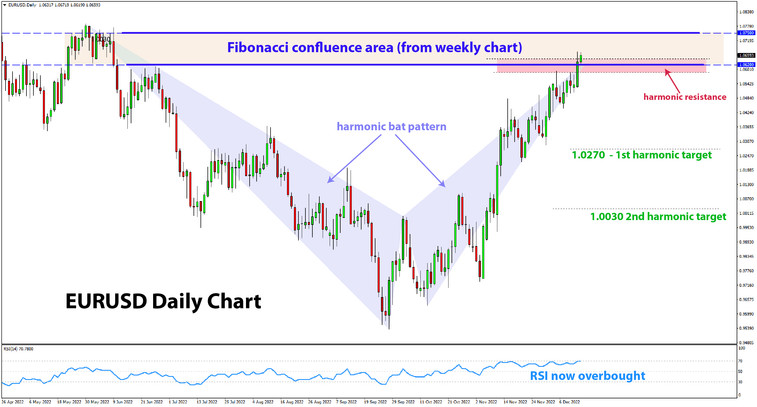

As can be seen on this weekly chart, the 1.0620 - 1.0750 area where EURUSD currently trades is a strong Fibonacci resistance confluence.

Usually, the market reacts at such Fib zones. Given that it’s the weekly chart, at least a 200 -300 pips move down is needed to qualify as a “reaction” to the resistance.

Given the overall situation on larger timeframes, and the major 2020 lows in this same area (around 1.06 - 1.07), a reaction here seems quite likely.

Switching to the daily chart, there is more to see. The upside move since early November has been very fast, and EURUSD is already into overbought levels on the RSI indicator (chart below).

Furthermore, in addition to the big Fibonacci resistance on the weekly chart, there is a “good-looking” harmonic bat here on the daily timeframe (see chart), making the current levels an even more robust Fibonacci area. As can be seen below, the harmonic bat resistance zone almost fully converges with the wider Fibonacci area from the weekly chart and only begins some 10-20 pips lower. So, from this perspective, EURUSD is already inside of a very “robust” resistance area.

The targets of the bat pattern are 1.0270 (1st) and 1.0030 (2nd). As is often the case with harmonic patterns, if EURUSD does reverse here, then reaching at least the 1st target will become very likely (1.0270).

Fed meeting tonight unlikely to be a bullish catalyst at these “high” EURUSD levels

We leave the Fed meeting discussion at the end of this newsletter, even though it is absolutely the most important event this week. The reason is that it’s worth putting it in the larger context of the EURUSD pair instead of focusing on the very near term.

As discussed above, both the fundamentals and technicals are now starting to point down for the pair. And, as is often the case, there should be very few surprises from the Fed tonight. This means the actual market reaction could be rather muted (although a volatile reaction is more likely).

Still, no matter what the Fed does or says, the technical resistance, coupled with the now exhausted upside move, suggests the odds are in favour of a downside reversal over the coming days and weeks. As a result, EURUSD should be more likely to trade at 1.02 - 1.03 again than rally to 1.10.

Let’s see what happens.

Trade Plan

Given the high-impact risk event of the Fed meeting tonight, volatility is almost guaranteed. Thus, we should all be extra careful, have a clear exit strategy and honour our exit and stop-loss rules.

EURUSD will either reverse down today or (in the unlikely case the Fed is dovish) push higher strongly. The robust Fibonacci confluence resistance suggests an upside breakout could lead to a very fast appreciation higher if it happens (as a lot of market orders are located in the Fibonacci area). Thus, this scenario is the big risk to short trades, and although unlikely, it is of course, possible (as is anything in markets).

A final possible scenario is that of a muted market reaction to the Fed tonight. Still, this scenario would be more in line with the bearish reversal scenario since if the market can’t keep going higher, it eventually has to come down. We would stay short under such a “muted Fed reaction” scenario.

Entry:

- Short around current levels (1.0650);

- of course, if possible, better to enter at higher levels closer to the 1.0750 level (top of the weekly Fibonacci area)

- The volatility around the Fed meeting tonight could be used to short at such higher levels; EURUSD may spike toward 1.0750, only to come back down later

Stop loss:

- Look to place a relatively tight stop loss above the 1.0750 top of the Fibonacci confluence area

Targets:

- 1st: 1.0270 (38.2% harmonic bat target)

- 2nd: 1.0030 (61.8% harmonic bat target)

- Longer-term targets: sub-parity levels like the 0.97 zone could still be possible

Some quick notes about what to expect from the Fed tonight:

- Fed will hike interest rates by 50bp, bringing the Fed funds rate to 4.5%

- Will likely announce a further decrease of the hiking pace to 25bp increments from the next meeting (on Feb 1)

- Fed to project interest rates will reach close to around 5% next year before they pose the hiking cycle (these projections can have a big market impact)

- Fed won’t like the unwarranted loosening of financial conditions (falling Treasury yields and rising stock market);

- Looser financial conditions make the Fed’s job of fighting high inflation harder, which is why eventually, the Fed is likely to push back against this.

- May push back against pivot speculation and falling yields already at tonight’s meeting; (this could be bullish USD, though not necessarily in the immediate reaction)