This trade idea was first sent to subscribers of the Free Profitable Forex Newsletter on September 22, 2022.

Quick update on our open trades:

Both the short EURUSD and short NZDJPY trades are working well so far and proceeding toward the designated TP targets.

The NZDJPY short got a boost to the downside today on currency intervention by the BOJ and Japan’s Ministry of Finance. This is the first intervention to prop up a falling yen since 1998.

EURUSD also pushed lower faster after the hawkish Fed meeting yesterday. The FOMC raised rates by a “large” 75bp and announced more such large hikes could come in the remaining two meetings this year. The dollar is breaking to fresh cycle highs broadly (DXY index above 111.00).

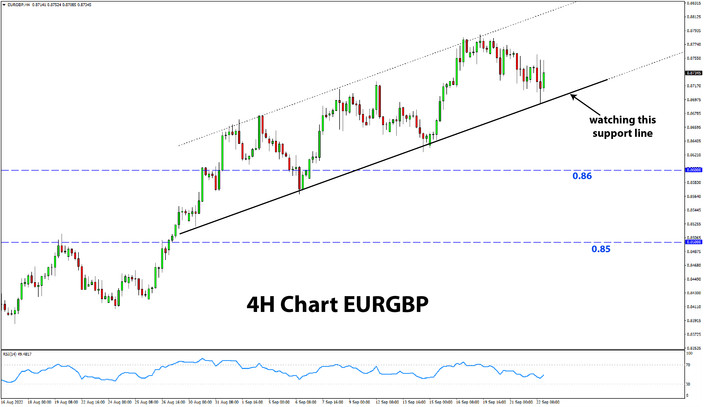

EURGBP testing resistance as BOE Fails to help weak GBP

EURGBP is on a wild ride in today’s session, moving up and down several times after the Bank of England meeting. Essentially, the BOE disappointed some market participants who expected them to offer more support to the falling pound. They hiked rates by “only” 50bp instead of a larger 75bp like many other central banks already have done (even the ECB).

For EURGBP, the fundamental picture remains mixed as both the euro and pound are broadly weak. The daily chart (see below) shows us that EURGBP has been rising (up swing) since early August, meaning that the EUR was stronger than GBP on a relative basis.

However, now that it has hit resistance in the 0.88 zone, perhaps the EUR’s outperformance is getting exhausted. A potential reversal here could give interesting opportunities to open a short trade.

To assess whether a short trade is worth taking or not (currently, it’s not!), we can watch the daily and 4H charts. As the above one shows, EURGBP has hit the resistance at the upper end of the large channel formation, but it is still trading inside of a (smaller) rising channel.

The 0.88 resistance zone can be considered to have successfully held if/when EURGBP breaks the smaller channel to the downside. Such a scenario would confirm the bearish setup and open the way for bearish opportunities to the downside. EURGBP can quickly fall toward the 0.86 and 0.85 zones in this case.

We can use the 4H chart (shown below) to get a more detailed picture of what’s happening with the market action. A break of the support trendline on the 4H chart can give an earlier signal to go short compared to waiting for the same breakout on the daily chart.

What could go wrong?

As always, when considering a potential trade, we must ask ourselves what could go wrong?

Essentially, both the GBP and the EUR are suffering from the same thing - the energy crisis that is unfolding in Europe as Russia has cut the gas supply amid the war in Ukraine. This is why both the GBP and EUR are falling broadly versus other currencies.

The main difference between the two is that the GBP is more sensitive to global risk sentiment than the EUR (i.e., the performance of stock markets). As the chart shows, stock markets (e.g., S&P 500) have been declining since August two, around the time when EURGBP started to move up.

Hence, the biggest risk to holding a long GBP position (by selling EURGBP) is a possible further slump in stocks. Most major stock indices are currently testing important support zones on their charts. If they break lower, it will likely be a catalyst for risk-sensitive currencies to fall too. This is a risk for this potential trade idea as EURGBP would likely break higher if stocks experience a big sell-off.

Trade with a Trusted and Professional Broker

Trade Plan

Entry:

- Wait for a break of the support line on the 4H chart (currently located around 0.87)

- Short entry on a confirmed break of the support line

Stop loss:

- Above the breakout point;

- At least above the 0.87 zone

Targets:

- 1st - 0.86

- 2nd 0.85

Trade signals from the past weeks

- September 9, 2022 - Short EURUSD from 1.0050 (trade idea sent Sep 2)

- September 15, 2022 - Short NZDJPY from 0.86 (open in progress)

TOTAL P/L in the past three weeks: N/A

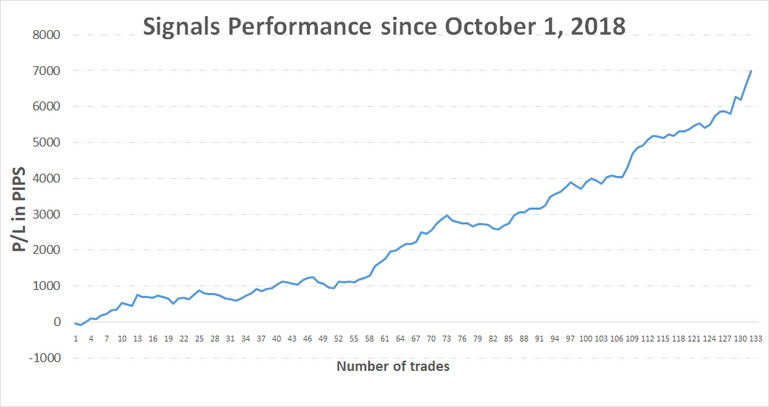

TOTAL: +6595 pips profit since October 1, 2018

![EURGBP: Watching a Potential Reversal [Newsletter Sep 22]](https://cdn.investworld.net/insecure/w:835/h:407/rt:fit/g:ce:0:0/el:1/f:jpg/c:0:0/q:90/czM6Ly9zZXJ2aWNlcy0tODM1OS0taW1hZ2VzLzYzMzJlZGFiZGQ0NWUzNzYyODk5NDc3YTdlMGY2NmRhN2FkY2IwZjgucG5n.jpg)