This trade idea was first sent to subscribers of the Free Profitable Forex Newsletter on September 15 2022.

Hey! This is Philip with this week's edition of the Free Profitable Forex Newsletter!

It’s difficult to feel confident about the markets in the current environment, especially about the JPY, given the recent sharp moves and risk of intervention from the BOJ. Still, a short NZDJPY trade idea looks interesting from at least two perspectives, with attractive risk-reward potential if it proves successful.

In last week’s newsletter, we discussed the developments in the yen currency and, specifically, the USDJPY pair. As we said there, the main risk to further continued JPY weakness is actual intervention from Japanese authorities. They have already verbally expressed dissatisfaction with the fast depreciation of their currency, and the next logical move is actual intervention in the market. If they go for that, it will surely result in some reversal of the recent moves and USDJPY, and other JPY pairs could easily fall by 500 pips or more.

Today, we are looking at a tactical short NZDJPY trade idea that would get a big boost if the BOJ indeed decides to go down the “intervention” path.

Some JPY strength (and therefore downside in NZDJPY) could come from one of two main factors:

- 1) actual BOJ intervention

- 2) a massive risk aversion sell-off in markets; a big and fast decline in stock markets.

The Japanese yen should strengthen if one of those factors materializes, and it is increasingly looking likely that one can actually happen over the coming weeks. For instance:

Bearish setup on the chart

The technicals suggest NZDJPY is at a key juncture, and if some support levels break, the floodgates to more downside potential will open. Some 500-600 pips downside action appears achievable based on the charts.

The daily chart below shows the 85.00 zone should be an important support. Multiple past lows and rebounds, as well as a rising trendline that goes back to May this year, converge at the 85.00 zone. A technical break lower would be a bearish signal.

To the upside, the resistance at the 87.00 - 88.00 area looks solid. The stop loss can be placed here, and if things unfold as anticipated, NZDJPY should move down from here. Past lows at the 82.00 and 80.00 zones to the downside indicate support will exist here and can be used as targets for this trade.

NZD’s bad fundamentals should help this trade

Finally, let’s discuss the NZD aspect of this short NZDJPY trade idea. The Kiwi dollar is the weakest of the three commodity currencies this year, and for good reasons. New Zealand is not benefiting from the rise in energy and oil prices, while Australia and Canada do as both countries are large exporters of energy products.

Therefore, when considering which currency to short against the JPY, the NZD looks like the better choice based on the predominant fundamentals. In this specific case, the NZD would also suffer in a scenario of worsening risk aversion, which is why this trade idea looks particularly interesting at the moment.

Trade Plan

Entry:

- This trade can be entered around current levels (86.00) or higher if the market gives an opportunity;

- Given the longer-term nature (expecting to hold it for at least several weeks), waiting for NZDJPY to climb a bit higher could actually pay off. This would reduce the distance to the stop loss and increase the reward-risk ratio.

Stop loss:

- Above the 88.00 high

Targets:

- 1st - 82.00

- 2nd - 80.00

Trade signals from the past weeks

- September 9, 2022 - Short EURUSD from 1.050 (trade idea sent Sep 2)

TOTAL P/L in the past three weeks: N/A

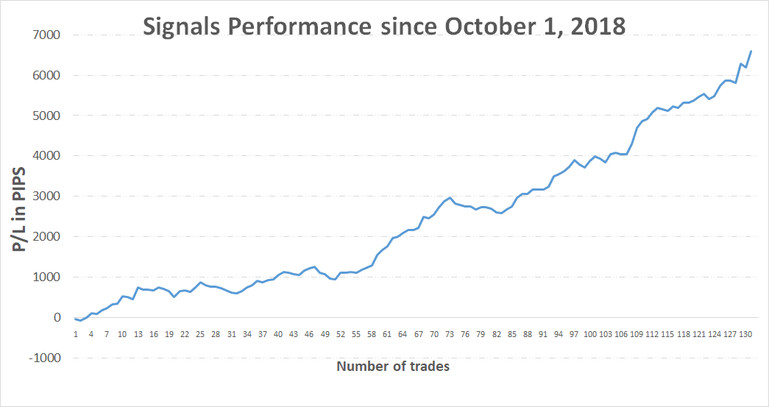

TOTAL: +6595 pips profit since October 1, 2018

![Sell NZDJPY - Trade With Big Potential [Newsletter Sep 15]](https://cdn.investworld.net/insecure/w:835/h:407/rt:fit/g:ce:0:0/el:1/f:jpg/c:0:0/q:90/czM6Ly9zZXJ2aWNlcy0tODM1OS0taW1hZ2VzL2JiYjllMTg1OWZjNzg0ODg5ODc2YTU0MTMyZGQ0MDk2ZDE2NTgwMzEucG5n.jpg)