After you have done forex trading for a while, you may find it very useful and convenient to build a forex trading system for yourself. This is essentially a set of rules that you establish for yourself that will act as a trading guide for you as you trade. Creating such a system makes trading easier since you spend less time thinking about when to enter or exit a market.

With your trading system in place, you simply follow the rules that you have established and wait until certain entry or exit signals are met. The main benefits of building your own forex trading are being able to quickly locate good entry points, finding profit-maximizing exits, and avoiding fake entries and exits.

In addition, a good trading system minimizes emotional trading which tends to lead to losses. In order for any trading system to be effective, you must write down the rules and you must be disciplined and trade according to the rules every time.

The process of creating a high-quality trading system entails a series of steps as follows:

Step 1 – Establish Your Preferred Timeframe

The first thing you will decide on when building your trading system is what timeframe you will be trading. If you prefer shorter trades and close them quickly, you can choose intraday time-frames like M1, M5, M15 or M30. However, short intraday time-frames usually require more screen time.

On the other hand, if you don’t mind waiting an entire day or a few days or longer for your position to entry and exit, then you would choose to work with the H4, daily or even longer timeframes.

The golden middle time frame is the H1 that is probably the most universal time-frame. You can simply trade almost any type of forex trading system with the H1 time-frame.

There is no hard and fast rule nor is there a better or worse timeframe. It all depends on how comfortable you are with the one that you decide on, and on how much time you can dedicate to trading. Avoid choosing a timeframe simply because other traders use those timeframes. The trading system should be built to suit you.

You should also define which currencies you would like to trade, and trading hours - especially in case of intraday trading. Again, the currencies you are going to trade and your trading hours should fit your life style as well as your trading system.

Step 2 – Decide Which Trading Tools You Will Use

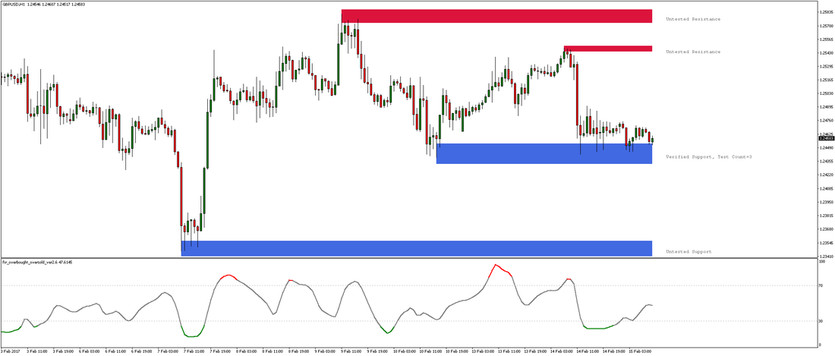

Trading tools should make it easier for you to identify trading opportunities and make better trading decisions. Therefore, the trading tools that you choose should be the ones that you are most proficient at using and the ones that you are most comfortable with. Generally speaking, a lot traders like to use Price Action and candlestick patterns . Others like to work with forex indicators to confirm trends after they are identified or trade entries / exits. Many traders use a combination of these tools for maximum benefit.

Step 3 – Decide How Much You Can Afford to Lose

A forex trading system is only useful if it helps you to minimize your losses. However, you must decide how much you are prepared to lose before trading. This prevents emotional trading and helps you to keep your losses within your established risk limit.

For this step, you decide how much of your account you will risk per trade or how many pips you are prepared to lose as well as the lot sizes that you will trade. Proper money-management and position sizing is a basic cornerstone of every successful trading system.

Step 4 – Decide on Good Entries and Good Exit Points

In this step, decisions are made regarding when to enter and when to exit each trade. Usually trades are entered as soon as the indicators or Price Action point to a good entry point.

The more conservative strategy is to wait until the signal candle has closed before entering. More aggressive traders may choose to enter before the candle actually closes. However, this strategy tends to be riskier since the market may move against you, jeopardizing your entry position.

For exits, a clearly defined plan is necessary as well.

Step 5 – Test Your Trading System

The final step is testing your trading system over a certain number of trades and time. If your trading system can be automated, then you can try to back test your system via a strategy tester. Otherwise you can just go through historical data and record possible trade entries, exits and theoretical results manually.

If you are satisfied you should proceed to open a demo account to conduct live virtual trading.

At the end of this testing period, you should feel satisfied with the results achieved. If so, then congratulations! You can move on to trading with a real account! If not, adjust your trading system and retest until you are satisfied.

Happy trading!