Range trading and trend following are two common forex trading strategies. The strategies differ in several different ways and while some traders prefer to trade with the trend, others prefer to undergo range trading within established limits of a market. Both strategies have drawbacks but both also create potential for making good profits. The style that you choose depends on your own preference, risk profile, your trading goals, as well as current market situation.

What is Range Trading?

Range trading, as the name suggests, involves trading within a narrow range. That range is usually between an established support and an established resistance level. With this strategy, the trader is looking to make profits by entering and exiting the trade near to the support or resistance levels. Traders who use this strategy usually aim to buy low and sell high. The expectation is that the price of a currency pair will eventually revert to the other side of the established range. Indicators and Candlestick patterns are useful tools for identifying the best times to enter these trades.

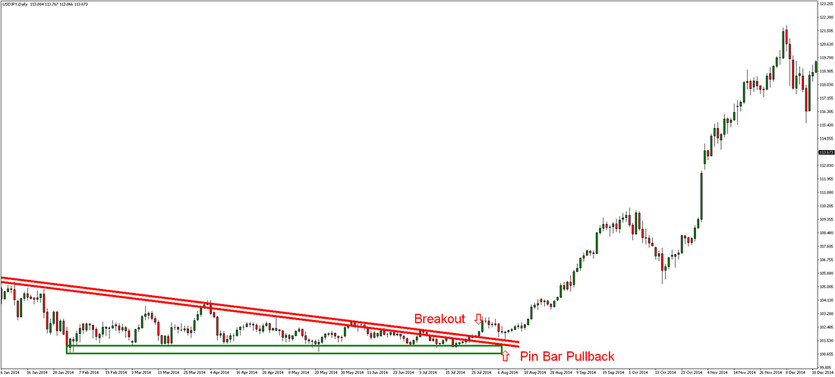

In the picture above you can see a very nice trading range. While the lower level of the range was a strong support zone, the higher level of the range was formed by the red descending resistance zone. This can be also considered as the triangle chart pattern. Also note how the market was bouncing from both zones and the Price Action patterns signaling reversals from the zones.

One drawback to range trading is that the profit potential is limited due to the fact that entries and exits are made within narrow support and resistance levels. However, if the trader is comfortable with smaller profits which add up over time, range trading may be worth consideration.

Apart from trading within the boundaries of the resistance and support levels, a range trader may also opt to trade breakouts. This means that the aim is to profit from the breakout of the range. The trick is accurately predicting which direction the breakout will take place if at all.

In the chart above - you can clearly see the situation where the breakout of the range happened. Than one Pin Bar pullback followed and the huge bullish trend was established.

The upper and lower boundaries (resistance and support levels) indicate that buyers and sellers are battling for control of the next trend. This will take place for a while before a new trend develops and it usually takes place after a breakout of a range happens. Usually it is quite easy to predict how prices are likely to move once the boundaries of a range are clearly established. A range trader takes advantage of these facts and aims to make the maximum profits out of these types of situations.

What is Trend Following?

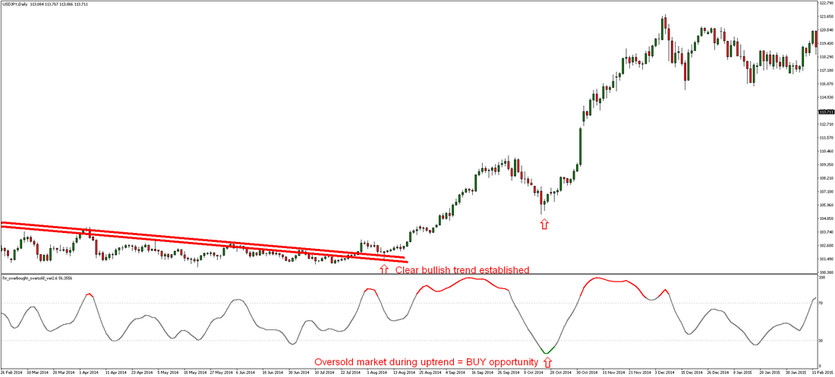

Trend following is a popular strategy among forex traders. It essentially involves identifying trends and trading in accordance with those trends. In other words, if prices are trending up, the trader would place buy trades and if prices are trending down, the trader would place sell trades in order to profit. If the market is flat and there is no trend, the trader would wait until the next up or downtrend develops before entering his trade. Compared to range trading, trend following can be a simpler, more straight-forward strategy.

Whereas range trading usually takes place over relatively short timeframes, trend following takes advantage of the patterns that have formed over longer timeframes. Once these patterns are clearly established, the trader expects that similar patterns are likely to continue going forward unless there is a trend reversal.

The aim with trend following is to buy high - after a bearish correction - and expecting continuous upside move, and sell low - after a bullish correction - and expecting continuous downside move. The most favorite way to enter these trades is to wait until an uptrend pulls back a little first before buying or waiting until a downtrend pushes upward first before selling. By doing so, if the market continues against your intended position, the position can be exited when losses are small. On the other hand, if the market moves in the direction that the trader intends, there is the potential to make very profitable trades.

Note in the picture above how clearly our Overbought & Oversold forex indicator signaled the bearish correction (oversold market conditions) that appeared during the established bullish trend. This was a great trend following opportunity.

It is important that longer timeframes are used to establish the existence of trends. Then the trader can look at multiple timeframes to make decisions in accordance with his preferred trading timeframe. Both price action as well as other indicators such as moving averages, may be used to determine the strength of a trend. The stronger the trend, the more likely it is to continue and the greater the potential for profiting by trading in accordance with that trend. However, there is no guarantee that the trend will continue. If this occurs, the aim should be to keep losses to a minimum.

Whether you choose trend following or range trading as your preferred forex trading method, there are opportunities for profiting. However, the aim in any strategy should be to minimize potential losses. This can be done by a proper money management as well as analyzing current market situation, and choose appropriate trading style - to follow the trend or to trade in a range.