Created in the late 1950s, George Lane developed Stochastic Oscillator to serve as a momentum indicator. Thus, it is created to show the essential information such as the location of all close relations or prices to high-low series over a prearranged phase of time.

Based on an interview with the developer himself, the tool Stochastic Oscillator was not made to follow price.

In addition, it does not follow any volume or something like that since it was specifically made to follow the momentum or speed of price. As a matter of fact, it follows a constant rule where the momentum modifies its direction before the price changes.

You can download this indicator for FREE at the end of this article.

Using the Stochastic Oscillator

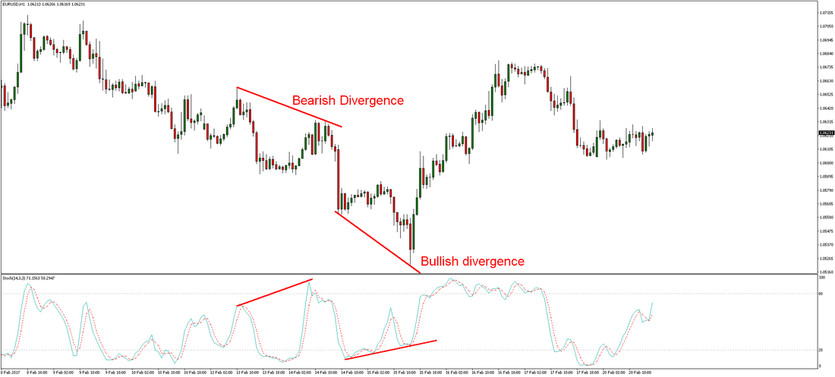

Therefore, the bearish and bullish divergence in Stochastic Oscillator can be a big help for foreshadowing reversals. In fact, this was the first ever and most essential sign that George Lane has identified. So, Stochastic Oscillator was also used by Lane to recognize every inch of the bear and bull set-ups and expect a turnaround in the future.

Divergence happens if a market is making different swing highs or lows than the Stochastic Oscillator - like you can see in the two examples below. In the first one, the market did two lower highs while the indicator's second swing was higher. And then in case of the second example, the market's second swing was a lower low, but the indicator started to making higher low.

Calculating the Stochastic Oscillator

In the calculation model, 14 is the numerical figure that has been in use ever since it was created. However, it can also depend on the goal of technicians, and if they want to analyze short-term, middle-term or long-term moves. Chartists can examine any time period they want to and for a very long term analysis, chartists often start by checking out the whole trading series of the market at 14 months. 14 months also reflect the 14 periods of this tool’s setting (in case that it is used at the monthly time-frame).

The calculation of the Stochastic Oscillator looks like below:

%K = (recent close – lowest low) / (highest high – lowest low ) * 100

%D = 3 period SMA of %K

The lowest low and the highest high pertain to the look back period of time. Then, %K is multiplied to 100 in order to move its decimal point to 2 places.

14 period percentage K would use what is the most current price. The “highest high” over the previous 14 periods and the “lowest low” over the previous 14 periods. Percentage D can be considered as the moving average of percentage K in 3 periods (this can be set differently as well). Stochastic Oscillator is one of the topmost handy tools used in Forex as an indicator in chart analysis. This tool determines where and how a trend might end up in the market with its 0 – 100 scale.

Overbought and Oversold Signals of the Stochastic Oscillator

Another possible use of the Stochastic indicator is determining when a market is becoming overbought or oversold. If the lines of Stochastic are beyond 80, it signals an overbought market. But if the lines of Stochastic are underneath 20, it signals an oversold market. Traders can consider opening a SELL trade once this indicator hikes beyond 80 and cross back the 80 level, and a BUY trade once it drops and grows above 20 again.

As a golden rule of trading, buy if the market signals oversold and sell if the market signals overbought. However, the key to success here is to avoid strong market moves driven by fundamentals. So trading signals of Stochastic Oscillator suit the best to range market moves.

Based on the nature of how the Stochastic Oscillator works, it is usually the best to use it in a conjunction with other tools - like supports and resistances , candlestick patterns , Price Action , fibonacci retracement , or other forex indicators .

Especially analyzing the long-term trend and going in the direction of that trend can be a very powerful trading strategy. The trend following strategy can be built with as simple tools as Moving Average and the Stochastic Oscillator. In the chart below, you can see how nicely the 80 signal level worked in case of the bearish trend.

The Stochastic Oscillator can be also used for closing opened trades. Simply consider closing a BUY trade as soon as the Stochastic indicator approaches the 80 level signalizing that the market is becoming overbought. And consider closing a SELL trade as soon as the Stochastic indicator approaches the 20 level signalizing that the market may become oversold.

Stochastic Oscillator can be easily used by veteran technicians as well as new traders which made this an accurate indicator and in-demand tool.

Download the Stochastic Oscillator from the button below