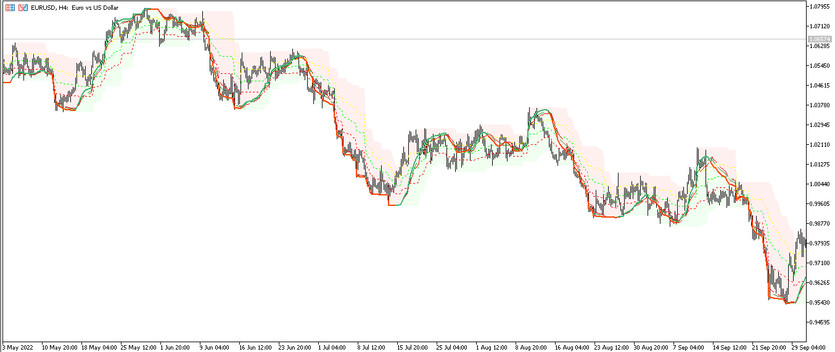

The QQE of RSIOMA indicator is a full-fledged trading algorithm based on the functioning of two effective indicators. This indicator is multifunctional, that is, it can be used for various trading purposes, for example, to determine the current trend and its strength, as well as trading in this period. It is displayed directly on the price chart in the form of six lines: in the form of three QQE lines - the main and two signal, as well as three signal levels that help to determine whether the market is in the overbought or oversold zone. Opening trades using the indicator is based on the intersection and direction of the lines, as well as their presence in the zone of upward or downward movement.

The QQE of RSIOMA indicator is suitable for trading on any timeframe using any currency pair.

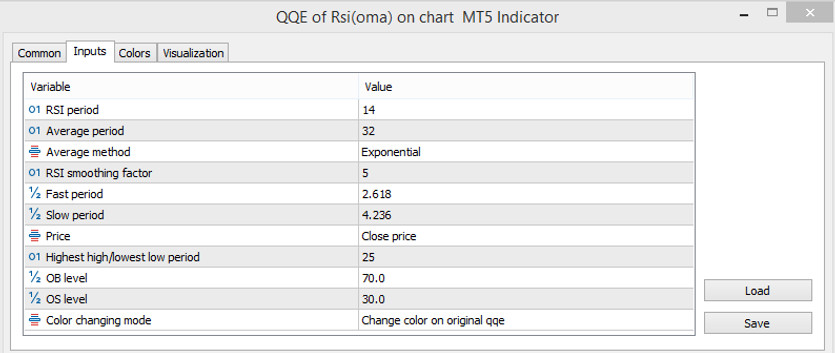

Input parameters

The QQE of RSIOMA indicator has fairly advanced settings, consisting of eleven input parameters, each of which to some extent affects the overall functioning of the indicator, and before changing their values, it should be taken into account all the nuances of trading. In the indicator settings of the Colors section, general visualization of lines and their color scheme can be changed.

- RSI period - period of the RSI indicator. The default value is 14.

- Average period - smoothing period of the moving average of the indicator. The default value is 32.

- Average method - the type of moving averages used in the indicator's calculations. The default value is Exponential.

- RSI smoothing factor - RSI calculation smoothing value. The default value is 5.

- Fast period - fast RSI period. The default value is 2.618.

- Slow period - slow RSI period. The default value is 4.236.

- Price - type of the price to which the general calculations of the indicator are applied. The default value is Close price.

- Highest high/lowest low period - period of high and low zone of the indicator. The default value is 25.

- OB level - overbought zone level value. The default value is 70.0.

- OS level - oversold level value. The default value is 30.0.

- Color changing mode - a parameter that defines a line that will change color when a certain market movement is detected. The default value is Change color on original QQE.

Indicator signals

The QQE of RSIOMA indicator is used for trend trading, that is, to open a certain trade, the current market movement should be taken into account. To do this, it is necessary to take into account the general direction of the lines, the sequence of their intersections, and finding them relative to three signal levels. And if the desired combination of conditions coincides on a certain candle characterizing an uptrend, a long position can be opened, and if the trend is down, a short position can be opened.

Signal for Buy trades:

- The indicator lines are in the uptrend zone and move up. At the same time, they are arranged in the following order: the main QQE line is above two signal lines, the fast one is above the slow one.

- The signal candle must close above the overbought level.

Upon receipt of such conditions, a buy trade may be opened on the signal candle, due to the presence of an uptrend in the market. The trade should be closed immediately after the reverse intersection of the indicator lines, at the same time as the market location changes in the rising zone. This will indicate a change in the current trend, which will allow consider opening new deals during this period.

Signal for Sell trades:

- The indicator lines move down and are located in the zone of downward movement. At the same time, the slow signal is higher than the fast one, which in turn is higher than the main QQE.

- The signal candle must be below the oversold level.

A sell trade can be opened immediately after receiving conditions that characterize a downtrend in the market. It is recommended to close the trade after changing the zone and direction of the indicator lines, or when they cross back. At this moment, it should prepared for a change in the current trend and opening new trades in its direction.

Conclusion

The QQE of RSIOMA indicator is a very efficient and accurate trading algorithm, thanks to which trades can be opened in the direction with the current trend. However, for profitable trading, it should be taken into account all the indicator conditions and wait for the full combination of conditions from the indicator. To obtain the necessary trading skills and gain sufficient experience, it is needed preliminary practice on a demo account.

You may also be interested The Normalized MACD of Averages Trend trading indicator for MT5