The application of Fibonacci levels is a fundamental part of the market analysis for most professional traders.

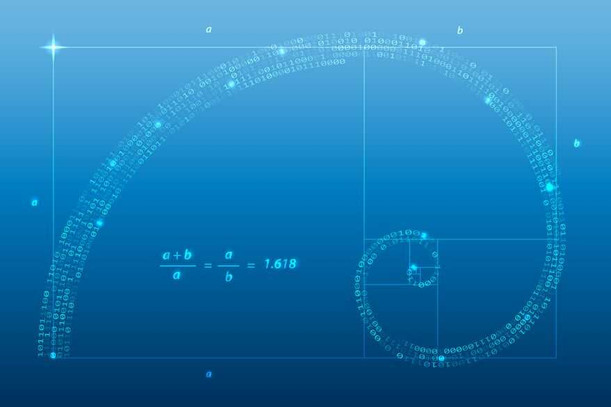

Fibonacci’s famous ratio theory can be applied in financial markets to predict at which price levels it is feasible to trade the market. Basically, the Fibonacci sequence is a sequence of numbers where each number is the sum of the previous two numbers.

It goes on as follows: 0, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89 ..... and so on to infinity.

Now, the sequence, in particular, doesn’t interest traders, but rather it’s the ratios between the numbers in the sequence that is useful in trading.

Golden Fibonacci Ratio

In this regard, 89/55 is 1.618 which is the golden Fibonacci ratio. By the same token, 55/89 is 0.618% which is the golden ratio in reverse.

Traders use the concept of the Golden Ratio to determine resistance or support levels on the chart. The Golden ratio is an important concept by itself as any number in this sequence can be predicted by multiplying the previous number by 1.618. Hence, traders multiply the price swings in the market by the Fibonacci ratios to determine potential support and resistance levels in the future.

For trading purposes, the 1.618% ratio is the most important Fibonacci extension level while 0.618% is the most important Fibonacci retracement level.

Why Fibonacci Retracements and Extensions are Useful

Before we go any further, it is important to understand what Fibonacci retracements and extensions are used for.

The Fibonacci retracement levels are generally used for finding entry points in the market while the Fibonacci extension levels are most often used as logical levels for traders to set their profit targets at.

However, this is not a rule set in stone and traders should keep in mind that in essence Fibonacci levels only represent a support or resistance level on the chart and as such, they can be used in many diverse ways and combinations.

In the market, it is not usually enough to determine the best point for entry. It is obviously crucial, however, equally important is the ability to determine the point in the future where the current trend might end or a reversal might occur.

Primarily, the Fibonacci extensions, based on the Golden ratio, help traders in determining such possible reversal points in the future. Fibonacci extensions are especially useful if a market has broken to an all time high or low and there are no previous resistance or support levels to look at, but the Fibonacci extensions.

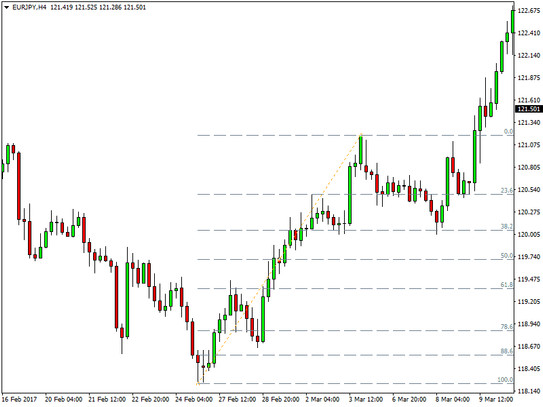

The Fibonacci retracement tool with the most important retracement levels plotted on the chart

The most important Fibonacci extension levels to plot on the charts are 61.8%, 100%, 138.2% and 161.8%.

Most of the time there will be no need to remember these figures since the Fibonacci extension tools available in most mainstream trading platforms already have the extensions levels built-in.

The patterns based on the Fibonacci ratios repeat themselves and with that provide brilliant opportunities to make profits with this tool.

Even though it is not required for the trader to have full technical knowledge related to Fibonacci numbers, the golden Ratio or Fibonacci extensions, it is still recommended to understand the basic concept to be better able to understand all the ways in which this tool can be used.

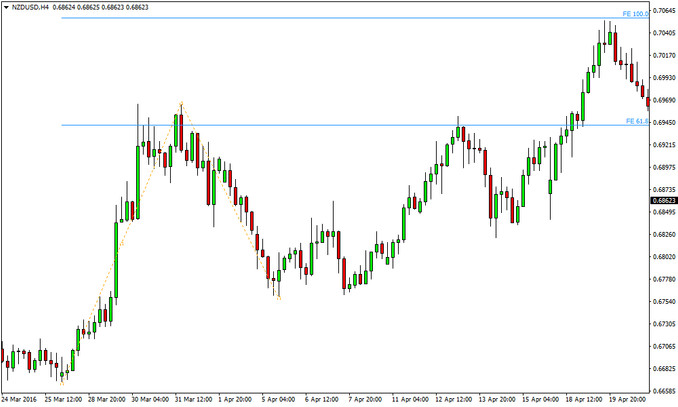

The Fibonacci extension tool on an NZDUSD 4h chart – Notice how the price stopped at both the 61.8% and the 100% Fib extensions.

The Fibonacci tool can be used on any time frame and the results it produces are not affected whether you use it on a daily chart or on a monthly chart.

There is no question about the effectiveness of the Fibonacci retracements and extensions. However, keep in mind that, like everything in trading, it is not a perfect trading tool. There is no guarantee that the prices will always reach the targeted Fib level and stop there.

Hence, the best strategy for most traders is to use Fibonacci levels as a part of an overall trading strategy instead of using it in isolation.

Also, worth noting is that when initiating a new position in the market it’s wiser to wait for extra confirmation of the validity of the signal at a particular Fibonacci level. So u sing the Price Action and the candlestick patterns in a conjunction with Fibonacci levels is usually a very good idea.

However, if already in a position, it is ok to book some or all profits earlier without waiting for extra confirmation. It’s always recommended to take what the market has given you and avoid risking giving back any pips you’ve already won.

Lastly, keep in mind that sometimes the price can just shoot through a Fibonacci level without looking back before reaching the next Fib level. Aggressive price movement through Fibonacci extensions is usually caused by the release of important news or a strong trend running its course in the market.