Using Profit Targets is a popular trading tactic for managing risk - reward ratios. Right before they enter the market, traders determine what would be a likely profitable exit point, where they can close out the position.

Setting the target ensures that our emotions do not take over the decision-making process during the time horizon of the trade.

Determining the suitable points for Profit Targets can be a challenging task, as such points are influenced by a wide range of factors, which must be taken into account when determining a Profit Target like a professional forex trader.

Primarily, those factors have to do with the market – with both the fundamental and technical aspects of the market at a given point in time. A Profit Target should never be placed based on wishful thinking or one’s desires, but rather on specific high-probability price levels in the market.

OK, so let’s look at a few ways how to set and use Profit Targets in your trading correctly.

Key Technical Levels

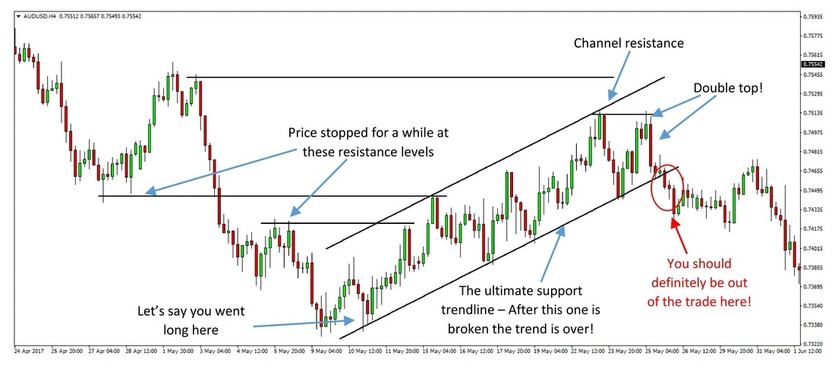

The first thing to be aware of before taking a trade and determining Profit Targets are pivotal support or resistance levels on the chart. The significance of a support or resistance level increases with higher timeframes, so a support on a monthly chart is more important than support on a daily chart.

In this regard, horizontal support and resistance levels work very well and the market respects them more often than not. Still, it’s also important to be aware of any other formations on the charts that could hold price, like parallel channels, head and shoulders , wedges , double tops etc.

The key point here is to set Profit Targets near such important price levels on the charts (usually closer to the current price, like above support and below resistance) and make sure that there are no other resistance levels (or support levels for a short trade) on the way from your entry point to your target.

As this example of the AUDUSD 4h chart shows, being aware of these levels was key in appropriately managing this hypothetical trade.

An example of a long trade on the AUDUSD 4-hour chart

Taking Partial Profits

Looking at the same AUDUSD 4h chart, we can see how taking partial profits would have worked marvelously in this trade example. Since this is a long trade example, resistance levels should be used as targets. For short trades, of course, support levels should be used as targets.

Profit Targets are set at each resistance level from the previous chart. You can see how, at some points on the chart, the horizontal resistance is at confluence with the channel resistance. These are excellent points to lock in partial profits.

Partial profits are a great tactic because they let us capture maximum profits during long trends while making profits and reducing the risk at the same time. We can see that the 3rd target was not reached and the price instead fell through the support trendline. Nevertheless, all three parts of the position were profitable in the end.

The same AUDUSD 4h chart showing how taking partial profits would work on the long trade example

Trailing Stop-Loss

Another effective technique for taking profits is the "trailing stop". This is a strategy best used during strong market trends or if you are a trend trader. The trailing stop trails the price with a fixed Stop-Loss size.

So, for example, if you set the trailing stop at 50 pips, it will trail the price at a fixed distance of 50 pips and as the trade moves into profit more and more so does the Stop-Loss by the same amount.

By this example, if the trade moves 200 pips in your favor your trailing stop will trail the trade at 50 pips – locking in a nice 150 pips profit. At the point when the price moves 50 pips against your direction, the trade will be closed.

The main disadvantage with this strategy is that it’s lagging and it tends to give away a sufficient amount of profits. Some traders don’t like this and they prefer to use a leading indicator to place profit targets, like Fibonacci projections or pivot points .

Still, at the true mastery level, it is possible to combine the two and use the trailing stop as protection until the final target is hit at which point the position is closed without waiting for the trailing stop to be hit.

Conclusion

Finally, there is one critical condition that must exist to set good Profit Targets that will bring long term profits in your account. And that condition is to:

Always look for your Profit Target to be at least the same amount as your risk for a given trade (or a very mildly negative if you achieve a high success rate).

The risked amount in trading is, of course, your Stop-Loss. And, that includes mental stops as well.

So, to sum it up, after determining the best Stop-Loss level based on the technical and fundamental situation in the market, and after you have determined the Profit Target based on the same technical and fundamental principles, you don’t just go ahead and take a trade.

Instead, you take a look at the size of the Stop-Loss and the size of the Profit Target and make sure that the Profit Target is always at least equal to or greater than the size of the Stop-Loss.

In short: Profit Target ≥ Stop Loss = Long-term positive consequences on your trading account.

Another possible approach is to achieve high success rate at a price of a mildly negative Profit-Target vs Stop Loss ratio. However, to constantly achieve very high success rate is usually very hard for forex traders.

But the one more golden rule applies here, remember: As long as your trade will be adopted to current market structure and volatility, you will achieve positive returns in the long term.